There are a lot of misconceptions surrounding probate. What is it? When is it necessary? Doesn’t my Will avoid probate?

Let’s bust those myths and answer the burning question of “When is a probate really necessary?”

The biggest factor that determine whether a probate is needed when someone dies is whether the person has assets that need to be probated. Sounds obvious, right?!

However, just because someone owns an asset or money when they die does not mean that a probate will be necessary.

Nor does having a Will guarantee that your estate will avoid probate when you die.

Here’s the easiest explanation I’ve come up with to explain if a probate is needed when someone dies.

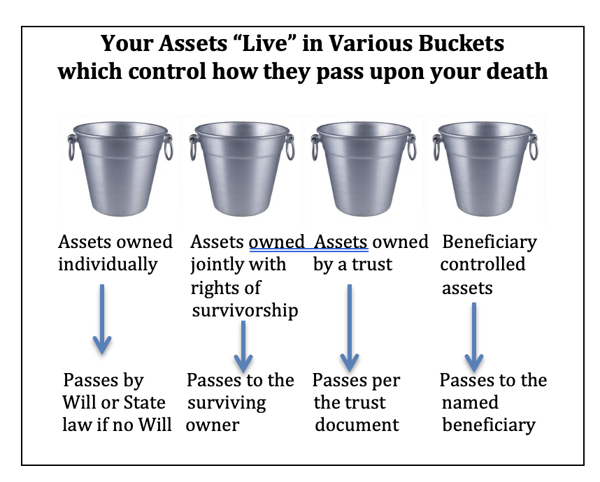

Every asset or financial account that you own “lives” in one of four different buckets.

Three of the four buckets do not require a probate to retitle the asset or account to someone else when you die.

It’s the fourth bucket that will require a probate to retitle assets or accounts upon death.

Bucket 1 are assets owned jointly with another person or people with rights of survivorship. You die and the surviving co-owner(s) now owns the entire asset or account. Think, “last man standing wins.”

In order for jointly owned assets or accounts to avoid probate, you must co-own the accounts as either “joint tenants with rights of survivorship” or for married couples, as “tenants by the entireties.”

Whereas, co-ownership as “tenants in common” will still require a probate of the deceased owner’s share.

Bucket 2 are assets or accounts where there is a surviving beneficiary on file for the asset. Examples of assets that typically have beneficiaries include life insurance policies, IRAs, annuities, and property that are the subject of ladybird (enhanced life estate) deeds. However, in order for this bucket to work, your beneficiary (or contingent beneficiary) must actually survive you.

Bucket 3 are assets owned by a trust. A trust cannot “die” and the trust agreement dictates what happens to the trust assets upon the trust creator’s death and who will be in charge to make it happen—the trustee.

It’s Bucket 4 where we have a probate issue. Bucket 4 assets are property or accounts that are owned in the individual name of the person (or a partial interest) that died with no beneficiary designation on file for such asset.

For example, Mr. Smith dies and he has a bank account titled solely in his name with no POD (payable on death) beneficiary on file for the account at the bank. The bank will not release the funds unless a probate its opened and the court directs who should inherit the account.

One of the biggest misconceptions I often hear about probate is that if a person has a valid Will when they die, that their assets will avoid probate.

No.

A Will only addresses your assets located in Bucket 4 (the first bucket in the attached graphic).

If you don’t have any assets in Bucket 4, then your Will becomes a moot point.

On the other hand, IF you have assets in Bucket 4 (titled in just your name with no beneficiary), then those assets will need to be probated after you die in order to remove your name from the title.

Rather than avoiding probate, your Will provides WRITTEN INSTRUCTIONS TO THE PROBATE COURT about who you want to inherit those assets in Bucket 4 when you die. Your Will doesn’t bypass probate; it merely clarifies how your assets located in Bucket 4 should pass.

Without getting any further into the weeds here, let me add one final comment that sometimes a probate is still necessary even if a person doesn’t have any assets located in Bucket 4.

For example, a person dies when they were in the middle of a lawsuit. In order to finish the lawsuit, someone must be appointed by a court to have legal authority to act on behalf of the deceased person to finish the lawsuit. That person in Florida is called a “personal representative” (means the same thing as an executor) and they are appointed by a probate judge.

The first thing I do with clients when I meet with them is to audit their existing assets and accounts. Where does their property “live”—in which bucket? This will tell me off the bat if probate is an issue. And if a priority of the client is to avoid probate when they die, then I know we need to shift their assets out of Bucket 4 into one of the other three buckets available to them.

Part of my job is helping clients decide which buckets best fit their needs based on their planning goals and who their intended beneficiaries will be.

Call our office if you’d like to schedule your own asset audit with me as a part of your initial estate planning consultation. Or to schedule an asset review audit if you are already an existing estate planning client of ours. 850-439-1191

Kristen “Helping Clients Avoid Probate for a Quarter Century and Counting” Marks

P.S. Order my FREE book on how to avoid the ten biggest estate planning mistakes in Florida here.