If you learn nothing else from my new book, WISE WOMEN PROTECT THEIR ASSETS: An Essential Estate Planning Checklist for Smart Women, master this concept about your own family succession planning. This common planning mistake trips most families up after the death of a loved one causing thousands of dollars in preventable legal fees and untold frustration for family members.

Many women mistakenly believe that the only pieces to their Family Succession Estate Plan is their written Will or Living Trust and other accompanying documents. However, your documents are only one crucial piece of your Family Succession Estate Plan.

A wise woman understands that her Estate Plan is more than just the written documents themselves.

Think of your family succession estate plan as more like a puzzle. Your estate plan is made up of various moving pieces that, when planned correctly, should give you the end result for your family that you desire. Some of those estate planning puzzle pieces consist of the following:

- The types of assets that you own

- The titling of your assets in various accounts

- The beneficiary designations of your various accounts, life insurance policies, annuities and retirement plans

- Who your family members are

- Your state inheritance and tax laws

- Federal inheritance and tax laws

- Your written documents

In other words, a written Will or Trust doesn’t do you a bit of good if those documents are not a part of a comprehensive plan of how everything should fit together to accomplish your desires and goals for family and loved ones.

In other words, your family succession estate planning documents should coordinate with State and Federal law, the titling of your assets, your beneficiary designations, etc.

In and of themselves, your estate planning documents may not give you the results you desire.

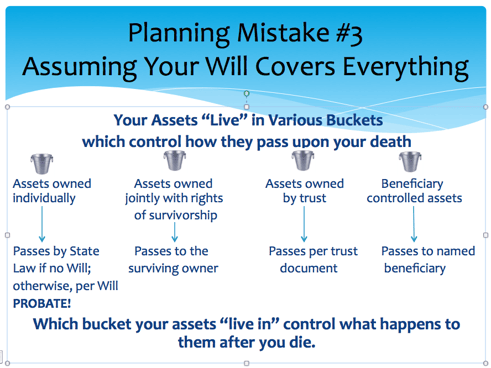

Another way to think about how your assets will pass upon your death is to think of your assets living in various “buckets.”

Which bucket your assets “live in” control what happens to them after you die.

Your Will only controls the assets living in Bucket 1 (see photo above). AND, assets living in Bucket 1 will require a PROBATE to pass to your intended recipients.

Assets living in Bucket 2 (joint with rights of survivorship) will pass automatically to the surviving co-owner regardless of any written documents you have in place. Bucket 2 assets "trump" your Will.

Only assets actually owned by (or payable to) your living trust--Bucket 3--will be controlled by the trust document. If you trust does not actually own your assets, the trust does you no good; it's just a pretty piece of paper.

Assets living in Bucket 4 with a beneficiary tied to it (common examples include life insurance, IRA's, annuities, brokerage accounts and other financial accounts) will pass upon your death to the named living beneficiary. It is irrelevant what your Will or Trust says. The beneficiary designation "trumps" your documents.

Make sure when you are working with your Family Succession Planning Advisor that they are asking you lots of questions to discern which "buckets" your assets live in. If they are only asking you what you want to say in your documents, the "advisor" is (a) not likely a qualified estate planning professional, and (b) you are likely going to end up with a plan that does not effectively carry out your intended wishes.

If you want to learn more about our 10 Point Family Succession Strategy Sessions, you may email me here.