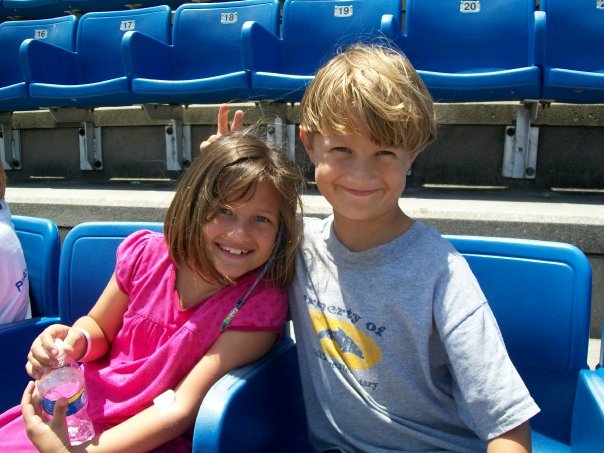

Another school year has flown by in the blink of an eye. My daughter is now a rising Senior in high school and my son will be a Sophomore this year.

Where Does the Time Go?

I remember crying when my daughter rode the bus to Kindergarten for the first time. Now, in less than two weeks, she’ll start applying to college!

My pediatrician was worried when my son didn’t walk until 16 months (he went from the military crawl, dragging his legs behind him while using his arms to propel himself forward, to running in one day!). Now, he’ll be taking his learner’s permit driving test next month.

As Parents, We Hope Our Kids Never Need This

Few of us ever imagine not living to see our children graduate from high school or drive a car. Yet, unfortunately, deaths of women in their middle age are on the rise in the United States and many of those dying leave young children behind.

I hope those of you with minor children never need this advice. However, since none of us know when “our time” will come, I hope you take action today on these seven simple and practical steps to plan for your children’s care if you are no longer able to do so yourself.

7 Simple Steps to Plan for Your Child’s Future

- Nominate caretaker guardian(s) for your children in writing.

This can be done as part of your estate planning—in your Will—or as a standalone document, or both.

Verbal communication is insufficient for the courts to honor and often leads to family conflict. If you fail to communicate your wishes in a legally binding, written document, you are placing your children at risk to competing family members and a judge, who doesn’t know your family dynamics, who will decide who should raise your children.

In an emergency, it is possible that when no adult has clear authority to take custody of your kids, even on a temporary basis, that your children will be placed in foster care pending a court hearing.

- Provide clear written guidance to your guardians.

In an emergency, your desired guardians must be prepared to go to your children and they must have knowledge of where the appropriate documentation is located which grants them legal authority to stay with your children.

It is also a good idea, not to mention great peace of mind, to arm your guardians with written instructions about how you want your children to be raised—the values that are important to you, the life lessons you want passed on, the relationships you want to continue to cultivate, etc.

- Ensure that babysitters have clear instructions in an emergency.

The last thing any parent wants is for the police to show up at your door after an accident and take custody of your kids because the babysitter does not have legal authority to stay with them.

Always leave clear written instructions (we print this on bright green paper in our office) for babysitters of who they should call in the event of an emergency to take temporary emergency custody of your children.

- Plan even if you are uncertain who should be named guardian.

Even if you are unsure who to name, chances are that anyone you do choose to be guardian will be a better option than the person that the Court, who does not know you, your children or your family or friends, will appoint.

Don’t let your reluctance to make a decision hold you back from making any decision at all. You can always change it later again in writing.

- Provide enough financial resources to raise your kids.

We all know how expensive it is to raise children. Now imagine imposing this financial burden on an unsuspecting family member or friend.

If you are young and healthy, term life insurance can be an inexpensive way to provide financial resources for your children to at least raise them to adulthood.

- Protect your children’s inheritance until they are older.

A minor cannot legally claim an inheritance on their own. And even young adults are often not yet mature enough to handle an inheritance.

Without a trust to hold your children’s inheritance until they are older, a child will receive their inheritance upon the age of majority (age 18 in Florida). Before then, the court will require that the funds be held in special type of guardianship or conservatorship that it will oversee. Beyond the additional expense of yet another court proceeding, there is no mechanism to mandate the funds be used for educational or other prudent purposes after the child becomes an adult and has access to the money.

- Name both caretaker guardians and financial trustees for your kids.

Caretaker guardians (also known as guardians of the person) are the people who will physically raise your kids. They will make decisions about where your kids live, their education, and their medical care.

Financial trustees are the people you want managing your children’s inheritance. They will invest the funds and dole it out for the permissible purposes you have hopefully spelled out for them in writing.

Caretaker and financial guardians or trustees do not have to be the same people but they can be. Oftentimes, however, the person you trust to raise and love your children are not necessarily the ones who you believe would be the best stewards of your children’s inheritance. It’s helpful to brainstorm the possible choices with your family succession advisor.

No One Wants to Think It But It’s Important to Be Prepared

My kids will both be 18 in just a few years yet it personally gives me great peace of mind as their mom to know that I do have a written plan for them if something happens to my husband and me in the meantime.

How to Get Started With Planning For Your Kids

Many clients have shared that the reason they waited so long to plan was because they did not know how to get started. I have good news because getting started is easy!

If you are a Florida Panhandle resident, you can learn more about our 10 Point Family Succession Planning Strategy Sessions here and even reserve your session. Hurry, because we only have a few sessions available to reserve in June.

If you are not a Florida resident, a great resource to locate estate planning attorneys near you is www.Avvo.com. Be sure to check out each attorney’s reviews from past clients.