A solid asset protection structure is an integral part of any estate plan where real estate investment properties are involved.

Statistically, an average US citizen has a 33% chance of being named in a lawsuit during her or his lifetime. Many activities, including owning investment properties (especially rentals), increase those odds.

An investor who owns multiple properties in her or his individual name is an easy target when litigation arises.

A large judgment can attach to as many properties as are owned, essentially wiping out all of the equity in as many investment properties as are necessary to satisfy the judgment amount.

Proper asset protection structures make identifying assets more difficult and can often thwart legal action before it begins.

If a lawsuit is filed, the right structure will effectively create a barrier between each of the investor’s individual assets, limiting the investor’s personal liability as well as the ability of a judgment to attach to other properties.

It is important to note that in order to be effective, an asset protection plan should be set up well in advance of any anticipated litigation.

An asset protection plan established after a lawsuit is filed or judgment is ordered is sure to be defeated.

A commonly used entity for shielding personal liability is the limited liability company (“LLC”).

The LLC became a popular choice for entity formation in the 1970’s due to favorable liability and tax implications.

One effective asset protection strategy for investors is to hold assets (real property) and liabilities in one LLC and perform management functions through another LLC.

This dual-LLC structure separates the assets from activities and reduces the risk of exposure by the asset-holding company.

A less common but effective entity for compartmentalizing assets and liabilities is the Series LLC.Thirteen states, including Texas, have recognized the Series LLC by statute.

While uncertainty exists regarding how the courts will treat these entities due to lack of case law, the Series LLC was first adopted in Delaware in 1996. In states that recognize it, the statutes are clear and, therefore, the structure is infrequently challenged.

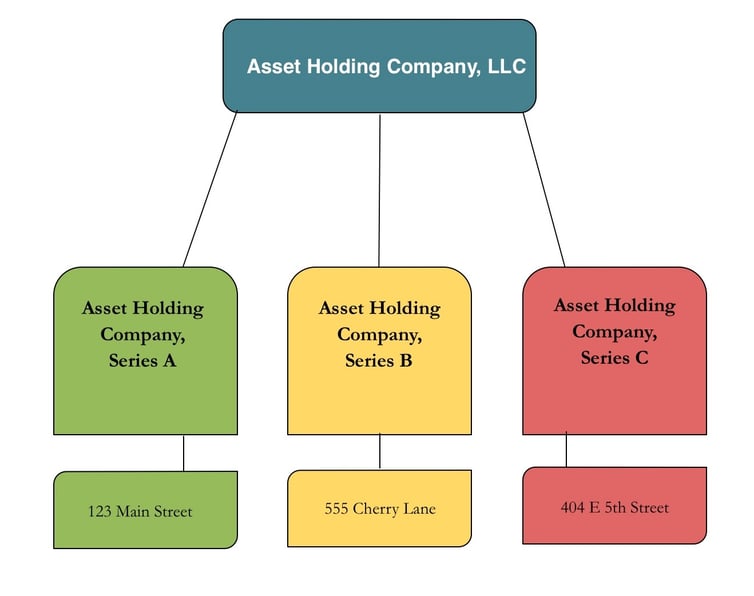

A Series LLC allows an investor to hold many assets and liabilities within separate series (sub-companies or “children”) of one entity (the “parent” LLC). Each series is treated as a separate entity and is shielded from the liability of another series, thus significantly reducing costs to setup and maintain multiple LLCs while affording the same protections as a traditional LLC.

Example: A judgment against Series A is only enforceable against Series A. A foreclosure in Series A results in a deficiency judgment. That judgment will only be enforceable against Series A assets and not against Series B, C, etc.; whereas a traditional LLC holds all properties together.

Here is how the Series LLC structure looks:

The Series LLC, in combination with a traditional LLC, offers the highest degree of asset protection with the lowest annual costs, while retaining the LLCs notorious tax advantages. Further, anonymity can be achieved by using trusts in combination with this structure, although we will save that discussion for another post.

Four Key Points to Achieving Asset Protection Goals:

- Set up an asset protection structure before litigation arises.

- Consult an experienced asset protection attorney.

- Update LLC records regularly.

- Keep assets and liabilities separate from activities.

A properly structured asset protection plan can significantly reduce your chances of being sued, and in the event that action is taken, drastically reduce the amount of damages available to a prevailing party.

A well-designed plan strategically structures properties to protect each from the liability of the others and is recommended for any estate plan containing investment properties.

The primary goals of estate planning are to ensure that loved ones are provided for and to facilitate the orderly transfer of assets at the time of death.

A solid asset protection plan helps to preserve those assets until that time comes.

Want to learn more about asset protection? Complete the "Contact Us" box at the top left of this article to reach out to us.